US faces Liz Truss-style market shock as debt soars, warns watchdog

The US faces a Liz Truss-style market shock if the government ignores the country’s ballooning federal debt, the head of Congress’s independent fiscal watchdog has warned.

Phillip Swagel, director of the Congressional Budget Office, said the mounting US fiscal burden was on an “unprecedented” trajectory, risking a crisis of the kind that sparked a run on the pound and the collapse of Truss’s government in the UK in 2022.

“The danger, of course, is what the UK faced with former prime minister Truss, where policymakers tried to take an action, and then there’s a market reaction to that action,” Swagel said in an interview with the Financial Times.

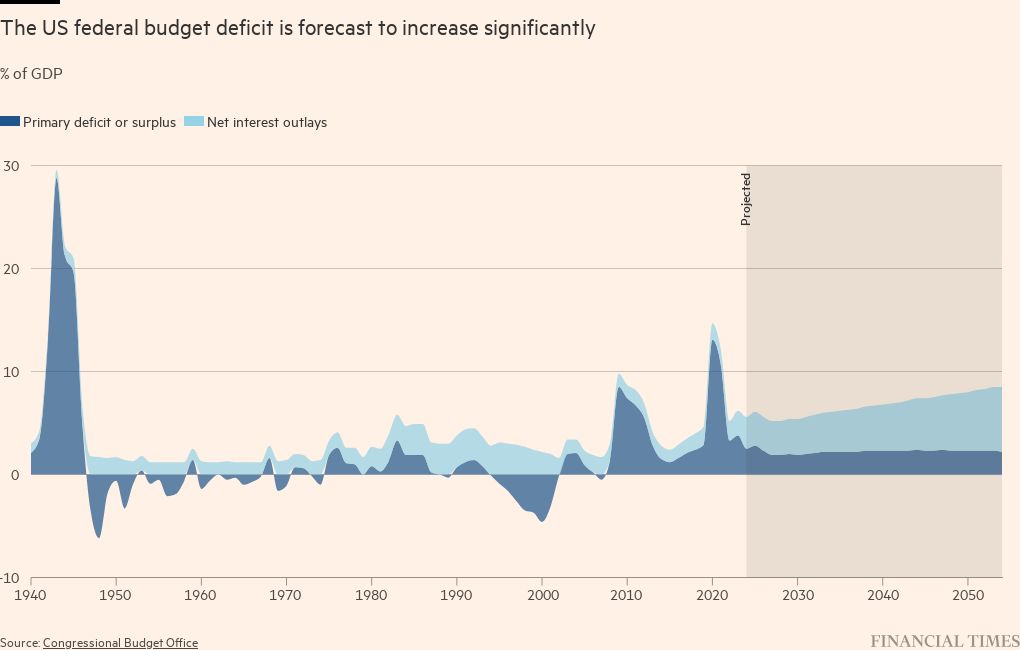

The US was “not there yet”, he said, but as higher interest rates raise the cost of paying its creditors to $1tn in 2026, bond markets could “snap back”.

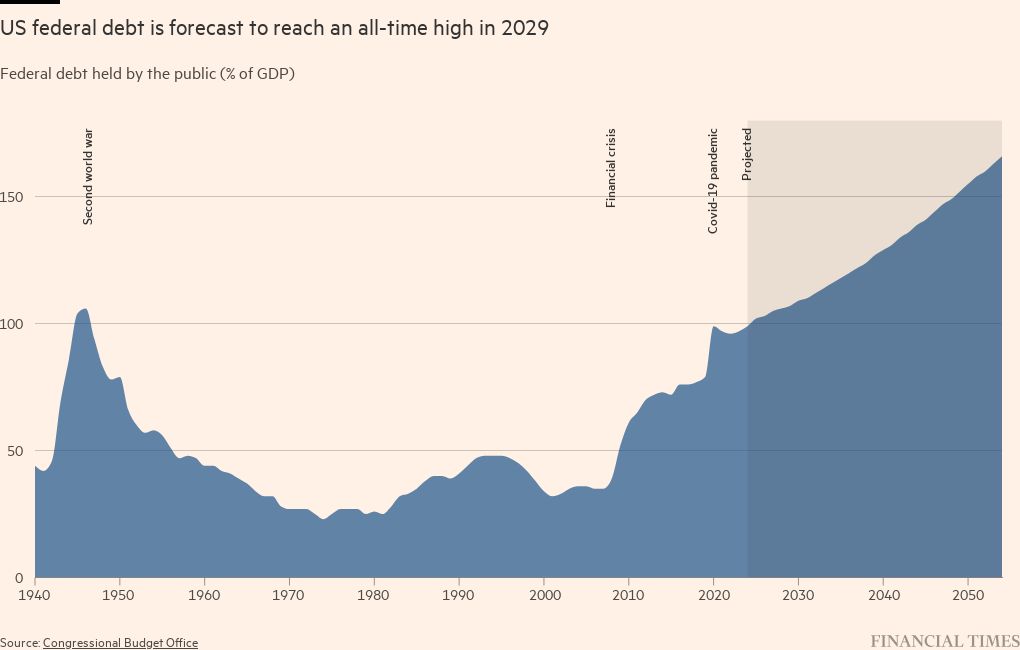

According to the CBO, the US’s federal debt pile amounted to $26.2tn, or 97 per cent of gross domestic product, at the end of last year.

It shot up after sweeping tax cuts by Donald Trump in 2017 and huge stimulus spending during the pandemic. Trump has pledged to renew the tax cuts, due to expire next year, if he defeats Joe Biden in this year’s presidential election.

“We have the potential for some changes that seem modest — or maybe start off modest and then get more serious — to have outsized effects on interest rates, and therefore on the fiscal trajectory,” Swagel said.

Truss quit after just 45 days as UK prime minister after her plan to pay for deep tax cuts with more debt backfired, sending the country’s borrowing costs sharply higher.

Swagel’s remarks to the FT came a day after the independent watchdog issued new longer-term economic projections, which showed debt levels rising to 166 per cent of GDP in 2054.

Fitch stripped the US of its triple A rating last year, citing concerns over “a high and growing general government debt burden”. Moody’s still rates the US triple A but said last November that it had changed its outlook from stable to negative.

The warnings from the CBO chief come amid fears among economists that years of fiscal profligacy by both Democrats and Republicans are storing up trouble for the US economy.

“It would behove policymakers to reduce deficits substantially in part because there are big demographic challenges coming down the pike,” said Kimberly Clausing, a senior fellow at the Peterson Institute think-tank.

“Neither [candidate for president] is talking about fiscal rectitude, and one of them is actually talking about extending tax cuts,” said David Page, head of macroeconomic research at Axa Investment Managers.

The Committee for a Responsible Federal Budget, a think-tank, said that if Trump renewed the tax cuts it would add another $5tn to the federal debt between 2026 and 2035.

The CBO’s forecasts show deficits hovering at about 6 per cent over the next 10 years — and are based on the planned expiry of the Trump tax cuts in 2025.

Swagel, who served in the US Treasury under Republican president George W Bush, acknowledged that next year would be important “for fiscal policy in particular”, given the debate over extending the tax cuts and Obama-era healthcare subsidies that are also due to expire.

The CBO projections issued this week showed debt-to-GDP levels surpassing their second world war high of 116 per cent in 2029 — a trajectory Swagel described as “unprecedented”.

“The debt that was run up during World War II was largely paid back within the generation of the people who fought the war,” Swagel said. “The fiscal burdens being generated today are not ones the current generation is going to bear the burden of.”

The dollar’s role as the world’s reserve currency would not always insulate the US from market pressures as debt interest payments increased, Swagel warned.

“We need to borrow from foreigners, because foreign capital helps keep interest rates low in the US,” Swagel said. “But there’s two sides to it, in that the cash flowing overseas means us losing national income. On the other hand, not having the capital coming in for us to borrow — boy, that would be even worse.”

Data visualisation by Oliver Roeder in New York

Comments